A critical shortage in 2008 encouraged the country's decision to devalue the Ethiopian currency, the birr in 2009, by 10 percent againt the US dollar.

The current shortage has been deemed serious by bank officials, following reports that the Commercial Bank of Ethiopia (CBE) has suspended opening letters of credit to businesses.

A letter of credit is a promise to pay. Banks issue letters of credit as a way to ensure sellers that they will get paid as long as they do what they have agreed to do.

A decision to suspend the issuing of letters of credit was made after there were signs of a marked decline in foreign trade in the past three months.

CBE is the biggest generator of foreign currency from its international banking department and from remittances.

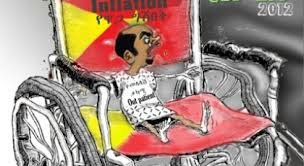

It is feared that the move could push up inflation and will have adverse effects on the livelihood of many citizens.

Many fear there will be a return to last year's sharp price increases and shortages of commodities, a situation that saw the government move to control and cap prices in order to ease inflation.

Sources at the country's largest bank have confirmed that the institution is currently opening letters of credit for basic items such as petroleum and medicine only.

11:15 AM

11:15 AM

Admin.

Admin.